Nerida Conisbee, Ray White Chief Economist

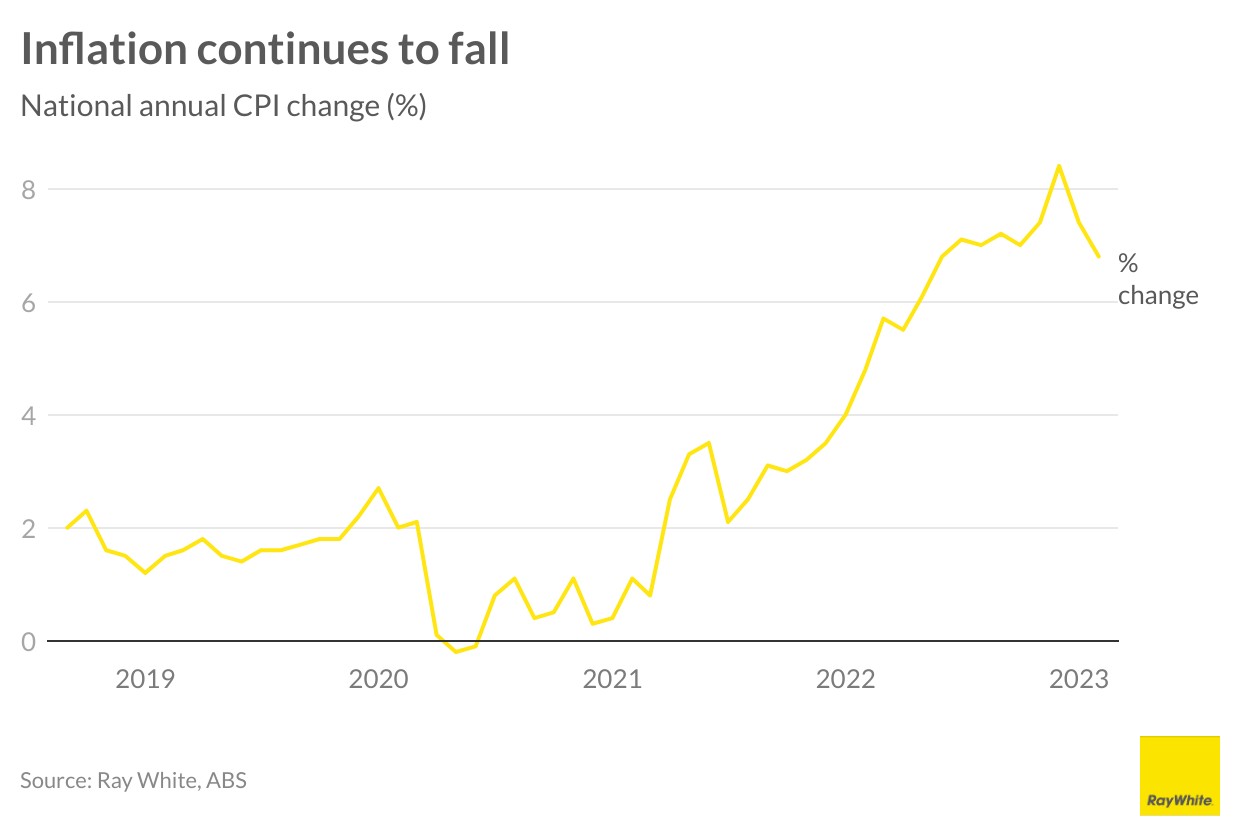

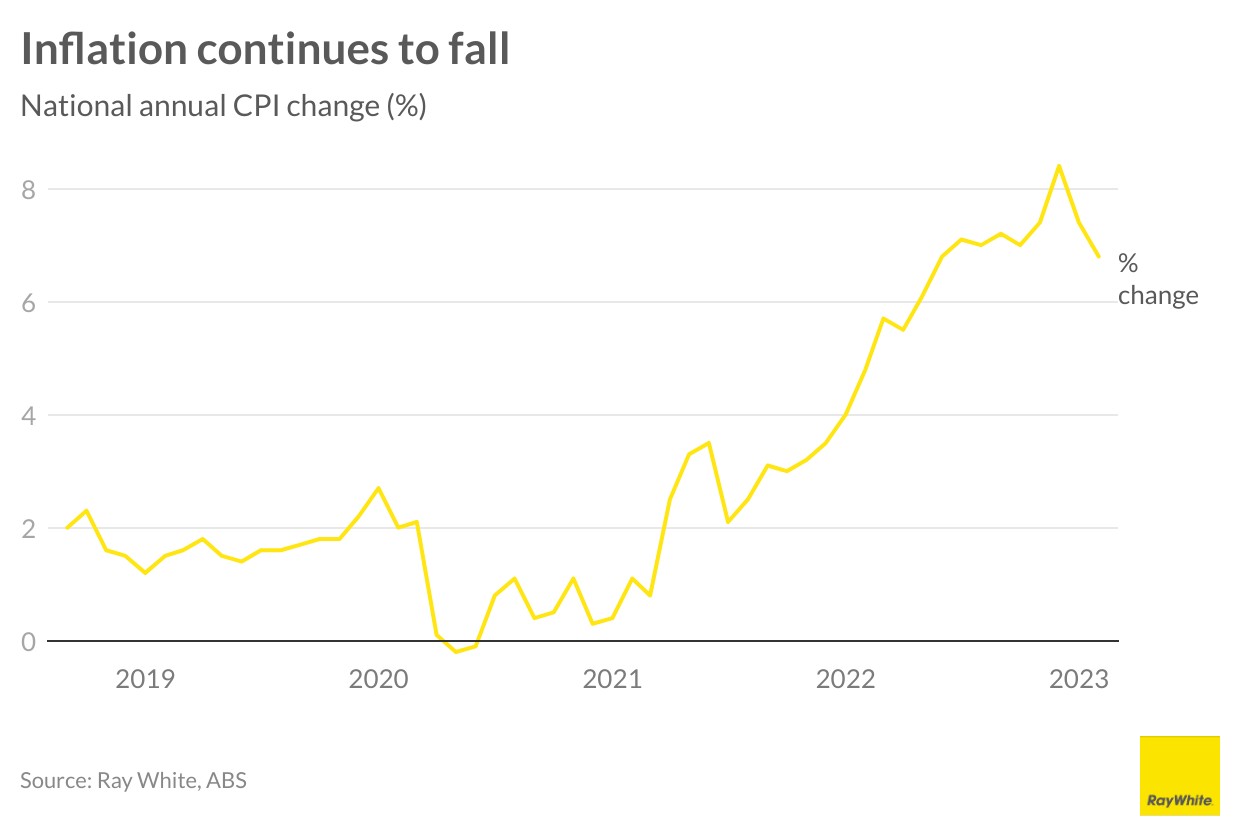

There were no surprises today that the Reserve Bank of Australia kept rates on hold. While concerns about a global banking crisis were a likely factor, it is good news that inflation is now pulling back quicker than expected. February inflation came in at 6.8 per cent. If this continues to come down over the coming months, it is likely that we are now at peak interest rates and the next change will be cut.

Housing remains the main driver of inflation, particularly construction costs. However, the rate of increase is slowing, primarily because the increase in the cost of building materials has eased. Rents, however, continue their rapid rise and are unlikely to ease anytime soon given a widespread shortage of homes. Other cost increases which have eased include food and automotive fuel.

It is highly unlikely that Australian banks will experience a similar situation to what is occurring in the US but the RBA needs to move carefully as Australia is not immune to a shaky global financial situation. Silicon Valley Bank’s collapse came about because they were betting on interest rates to remain ultra low for a long time and were holding a lot of long term bonds. Interest rate increases meant the value of the bonds collapsed and a bank run resulted. Credit Suisse’s problems have been a long time coming and problems in US banks exacerbated negative sentiment towards them. In Australia, our banks hold a very low proportion of tradable securities and also have significant liquidity should a bank run begin.

With the outlook for interest rates now looking far more positive for mortgage holders and those looking to buy a home, it is no surprise that house prices continue to move upwards. Price growth began again in December last year and is likely to continue for the remainder of the year.

Source article r: https://www.raywhite.com/rates-on-hold-as-inflation-pulls-back/